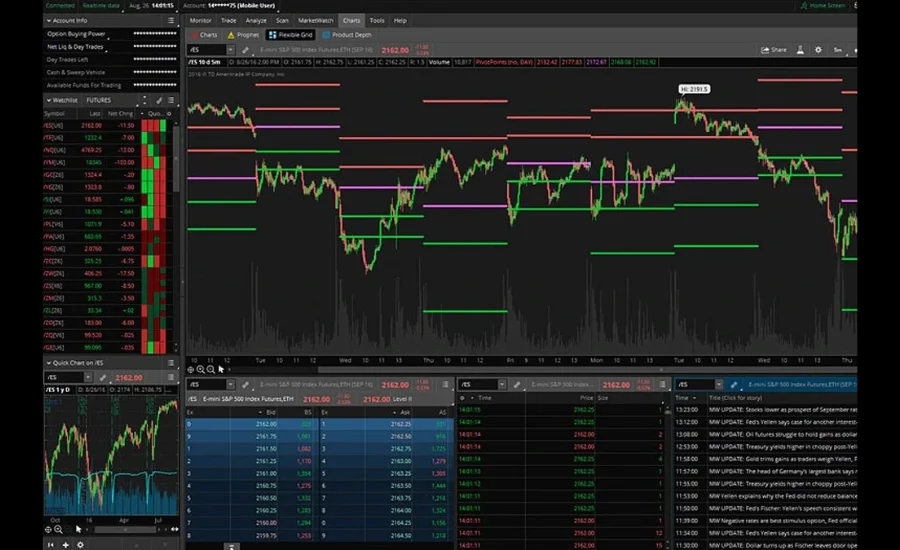

In the world of trading, utilizing the right tools can significantly impact your ability to make profitable decisions. Among these tools, the kdj 指标 thinkorswim stands out as a valuable asset for traders looking to enhance their analysis. Thinkorswim, a robust trading platform by TD Ameritrade, offers easy access to this powerful indicator, allowing traders to gain deeper insights into market trends.

The KDJ Indicator, an extension of the Stochastic Oscillator, helps traders identify potential price reversals by combining momentum, trend strength, and market direction. It uses three lines: %K, %D, and %J, each providing a unique perspective on market conditions. By understanding how to read these lines and their interactions, traders can make more informed decisions regarding entry and exit points.

With Thinkorswim, accessing and implementing the KDJ Indicator is straightforward. The platform’s intuitive interface ensures that even novice traders can benefit from this advanced tool. Once set up, it can be a game-changer for technical analysis, helping you spot trends early and adjust your strategies accordingly.

By integrating the KDJ Indicator into your trading routine on Thinkorswim, you’ll be better equipped to navigate the complexities of the market with confidence.In the world of trading, utilizing the right tools can significantly impact your ability to make profitable decisions. Among these tools, the KDJ Indicator stands out as a valuable asset for traders looking to enhance their analysis. Thinkorswim, a robust trading platform by TD Ameritrade, offers easy access to this powerful indicator, allowing traders to gain deeper insights into market trends.

The KDJ Indicator, an extension of the Stochastic Oscillator, helps traders identify potential price reversals by combining momentum, trend strength, and market direction. It uses three lines: %K, %D, and %J, each providing a unique perspective on market conditions. By understanding how to read these lines and their interactions, traders can make more informed decisions regarding entry and exit points.

By integrating the KDJ Indicator into your trading routine on Thinkorswim, you’ll be better equipped to navigate the complexities of the market with confidence.

Understanding the KDJ Indicator in Trading

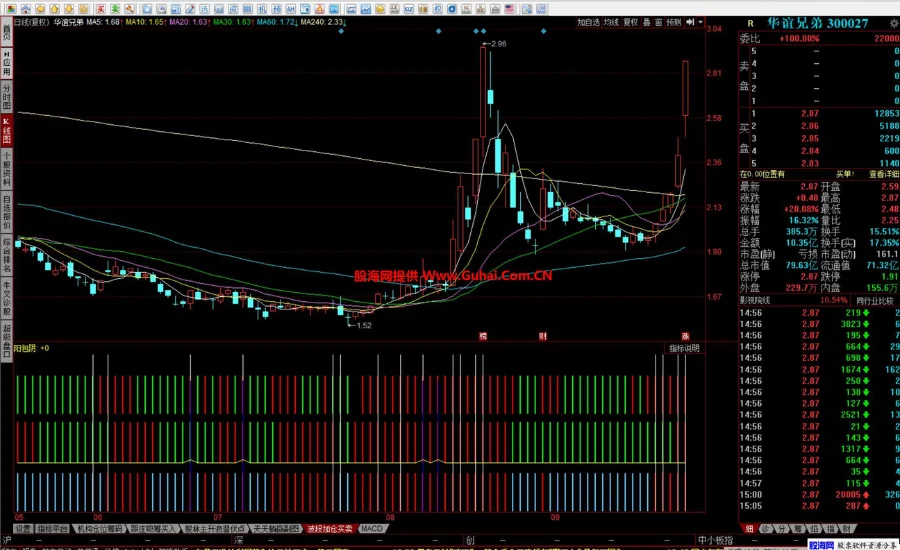

When it involves technical evaluation, traders have get admission to to a big selection of equipment and indicators designed to assist pick out marketplace tendencies and ability possibilities. One such tool is the kdj 指标 thinkorswim, a popular and effective technical indicator used by traders throughout various markets, along with stocks, forex, and commodities. This indicator combines factors of the Stochastic Oscillator, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) to provide a extra correct mirrored image of marketplace situations, making it a flexible desire for investors in search of an aspect in their trading techniques.

The KDJ Indicator is exceptionally valued for its potential to discover overbought and oversold situations, and it affords precious alerts approximately capability fashion reversals or continuations. By expertise how the KDJ Indicator works and a way to nicely use it, investors can enhance their ability to make well-knowledgeable, records-pushed selections.

How the KDJ Indicator Works

The KDJ Indicator is a composite of three awesome traces: K, D, and J. Each line gives precious perception into the charge momentum of an asset and affords traders with beneficial alerts for making access and exit choices. Here’s a better take a look at how every element of the KDJ Indicator works:

- K Line (Fast Stochastic Line): The K line reacts quick to market adjustments, making it one of the maximum touchy additives of the KDJ Indicator. This line oscillates between values of zero and one hundred. Values above eighty are usually considered to suggest that an asset is overbought, whilst values under 20 are frequently interpreted as oversold, suggesting a capability rate reversal.

- D Line (Slow Stochastic Line): The D line is a smoothed version of the K line and responds greater slowly to market fluctuations. By averaging the K line, it facilitates to filter out noise from smaller price movements and affords a clearer view of the general fashion in the marketplace.

- J Line: The J line is the specific component of the KDJ Indicator. It is derived from the distinction among the K and D traces, and it highlights ability momentum shifts in the marketplace. When the J line movements past the upper limit of a hundred or falls beneath the decrease restriction of zero, it indicates intense market conditions that would precede a reversal or correction.

The KDJ Indicator works by reading price momentum and figuring out intervals while the marketplace is overbought or oversold. Traders use these readings to assume ability reversals or market corrections, supporting them enter or exit positions with more self belief.

Setting Up the KDJ Indicator on Thinkorswim

Thinkorswim is a powerful trading platform presented via TD Ameritrade, providing investors with the tools they need to perform in-intensity market analysis. The KDJ Indicator is easily reachable on this platform, and setting it up is a simple process. Here’s a way to add the KDJ Indicator to your charts:

- Open Thinkorswim: If you don’t have Thinkorswim mounted, you’ll need to download and deploy the software from the TD Ameritrade internet site. Once installed, release the platform and log in to your account.

- Navigate to the Charts Tab: Once logged in, go to the Charts tab to get admission to the rate information for diverse belongings.

- Add the KDJ Indicator: In the Charts window, click on the “Studies” button, then choose “Edit Studies.” In the hunt bar of the “Edit Studies and Strategies” window, kind “KDJ.” If the indicator is available, it’s going to seem inside the listing of studies. Click on the indicator to select it and then press “Add Selected” to apply it to your chart.

- Customize the Indicator: Thinkorswim also allows you to personalize the KDJ Indicator settings. The default settings for the KDJ lines typically use a 14-length for the K and D lines, however those can be adjusted relying in your buying and selling preferences. You can exchange the period period primarily based for your strategy or the time frame in which you are trading.

Once the indicator is set up, the KDJ lines can be displayed on your chart, supplying valuable insights into marketplace situations.

Key Benefits of the KDJ Indicator

Traders who use the KDJ Indicator on Thinkorswim benefit from several blessings that assist them make more knowledgeable buying and selling decisions. Below are a number of the primary advantages of incorporating this indicator into your trading method:

- Clear Buy and Sell Signals: The KDJ Indicator gives extra accurate and actionable buy and promote signals as compared to other character indicators. Traders typically search for crossovers between the K and D lines, in addition to extreme readings at the J line, to identify capacity fashion reversals or continuation.

- Identifying Overbought and Oversold Conditions: One of the KDJ Indicator’s most critical functions is its ability to hit upon overbought or oversold marketplace situations. When the KDJ readings are extremely excessive (above one hundred) or low (below zero), it could imply that an asset is both overbought or oversold, signaling a capacity price reversal or marketplace correction.

- Combines Multiple Indicators: By integrating the Stochastic Oscillator, RSI, and MACD, the KDJ Indicator gives a greater holistic view of market momentum. This makes it a effective device for reducing false alerts, because it aligns multiple indicators to offer stronger confirmation of marketplace actions.

- Customization to Fit Your Strategy: Thinkorswim’s customization options permit traders to fine-music the KDJ Indicator’s settings to fit their unique trading techniques. Whether you’re a short-time period dealer or long-term investor, the KDJ Indicator can be adapted for distinctive asset kinds and timeframes.

Interpreting KDJ Signals

Understanding a way to interpret the signals from the KDJ Indicator is important for using it efficiently in your buying and selling. Here’s how to study the important thing signals that the KDJ Indicator generates:

- K Line and D Line Crossovers: The most fundamental and widely used signal from the KDJ Indicator takes place while the K line crosses above the D line (bullish crossover) or beneath it (bearish crossover). A bullish crossover suggests the potential for upward momentum, at the same time as a bearish crossover indicates the probability of a downtrend.

- J Line Extremes: The J line is in particular useful for detecting intense market situations. If the J line movements above a hundred, the asset may be taken into consideration overbought, and a reversal or correction might be drawing close. On the opposite hand, if the J line moves under zero, the asset can be oversold, and a capacity leap will be within the works.

- Divergence Signals: Divergence occurs whilst the price action of an asset contradicts the motion of the KDJ Indicator. For instance, if the rate is making new highs whilst the KDJ Indicator suggests decrease highs, it may sign that the fashion is losing momentum and can quickly opposite.

Developing Strategies with the KDJ Indicator

Once you understand how the KDJ Indicator works and the way to interpret its alerts, you could begin to expand powerful strategies to comprise it into your trading routine. Here are some strategies to keep in mind while using the KDJ Indicator:

- KDJ Crossover Strategy: This approach is based totally on the crossovers among the K and D lines. When the K line crosses above the D line, investors input a purchase role. Conversely, while the K line crosses beneath the D line, a promote or brief position is initiated. This strategy works high-quality in trending markets where the momentum is without a doubt in a single route.

- Overbought/Oversold Reversal Strategy: When the J line reaches intense values (above 100 or underneath zero), it is able to sign an overbought or oversold circumstance, suggesting a reversal. Traders can input a exchange inside the opposite direction as soon as those extreme stages are reached, in particular in variety-certain markets where fees oscillate between overbought and oversold conditions.

- Divergence Trading Strategy: Divergence alerts can be treasured for figuring out capacity trend reversals before they occur. If the fee is making new highs however the KDJ lines are displaying lower highs, it indicates weakening momentum and an forthcoming reversal. Traders can use this as a signal to enter a change inside the opposite course.

Avoiding Common Mistakes with the KDJ Indicator

Like all trading signs, the KDJ Indicator is not infallible, and it’s vital to keep away from certain pitfalls to ensure achievement. Here are a few common errors buyers need to remember of when the use of the KDJ Indicator:

- Relying Solely at the KDJ Indicator: While the KDJ Indicator is a powerful tool, it need to no longer be used in isolation. Always take into account combining it with different indicators, along with Moving Averages, RSI, or MACD, to verify signals and decrease the risk of false breakouts or reversals.

- Ignoring Market Conditions: The KDJ Indicator is handiest in trending markets, however it could generate false alerts for the duration of periods of market consolidation or sideways motion. Be sure to take the general marketplace environment under consideration when deciphering KDJ alerts.

- Not Adjusting Settings for Different Timeframes or Assets: The default settings for the KDJ Indicator may not be suitable for all assets or timeframes. It’s crucial to adjust the duration lengths in keeping with the asset you’re buying and selling and the timeframe you’re using. Short-time period buyers might also prefer a smaller KDJ length, at the same time as lengthy-time period buyers might also decide on a bigger placing.

Also Read: Latest Rarefiedtech.com Fintech

Final Words

The KDJ Indicator is a powerful device utilized in technical evaluation to pick out market trends and potential fee reversals. It combines factors from the Stochastic Oscillator, RSI, and MACD, presenting a greater accurate mirrored image of market situations. The KDJ Indicator consists of three lines: the K line (rapid stochastic), the D line (slow stochastic), and the J line, which highlights momentum shifts. By analyzing the crossovers between the K and D strains and looking at excessive values of the J line, investors can become aware of overbought or oversold conditions, signaling capacity reversals or tendencies. Thinkorswim, a famous trading platform, makes it smooth to integrate the KDJ Indicator, permitting buyers to personalize settings to suit their strategies. When used correctly, the KDJ Indicator enables traders make more knowledgeable, facts-pushed selections, improving their possibilities of success inside the marketplace. However, it is crucial to combine it with other indicators and adapt settings primarily based on marketplace situations and asset kinds.

FAQs

1. What is the KDJ Indicator used for in trading?

The KDJ Indicator enables investors discover overbought and oversold situations, capability fee reversals, and trend continuations. It combines elements from the Stochastic Oscillator, RSI, and MACD to give a clearer view of market momentum.

2. How do I installation the KDJ Indicator on Thinkorswim?

To installation the KDJ Indicator on Thinkorswim, navigate to the “Studies” phase, pick out “Edit Studies,” search for “KDJ,” and add it on your chart. You can then customize the settings based totally to your buying and selling choices.

three. What do the K, D, and J lines represent within the KDJ Indicator?

- The K Line is the short line that reacts quick to marketplace movements.

- The D Line is the sluggish line, a smoothed version of the K line.

- The J Line highlights momentum shifts by way of displaying the divergence among the K and D strains.

4. How can the KDJ Indicator assist identify fashion reversals?

The KDJ Indicator identifies trend reversals by means of detecting crossovers between the K and D lines, as well as severe readings at the J line. When the K line crosses above the D line, it indicates upward momentum; whilst it crosses beneath, it alerts a potential downtrend.

5. What is a bullish signal in the KDJ Indicator?

A bullish sign takes place when the K line crosses above the D line, signaling potential upward momentum. Traders may also enter a purchase position while this crossover occurs.

6. What is a bearish sign within the KDJ Indicator?

A bearish sign happens when the K line crosses beneath the D line, indicating a capability downward fashion. This is generally taken into consideration a sign to promote or short the asset.

7. Can the KDJ Indicator be used for all sorts of property?

Yes, the KDJ Indicator may be carried out to a extensive variety of property, along with shares, foreign exchange, and commodities. Traders can modify its settings based at the asset kind and buying and selling time frame.

eight. How can I avoid fake signals with the KDJ Indicator?

To avoid false signals, it’s essential now not to depend solely at the KDJ Indicator. Combine it with other indicators, which include Moving Averages or MACD, to confirm developments and improve sign accuracy.

9. What must I do when the J Line actions above one hundred or underneath zero?

When the J Line movements above 100, the asset may be overbought, signaling a possible reversal. If it movements beneath 0, the asset can be oversold, potentially indicating a price bounce.

10. How do I interpret divergence with the KDJ Indicator?

Divergence takes place while the price is shifting within the contrary route of the KDJ Indicator. For instance, if the price is growing while the KDJ lines show decrease highs, it could sign weakening momentum and a potential reversal.

For the great insights on egg development and extra, go to Discover Outlooks these days!